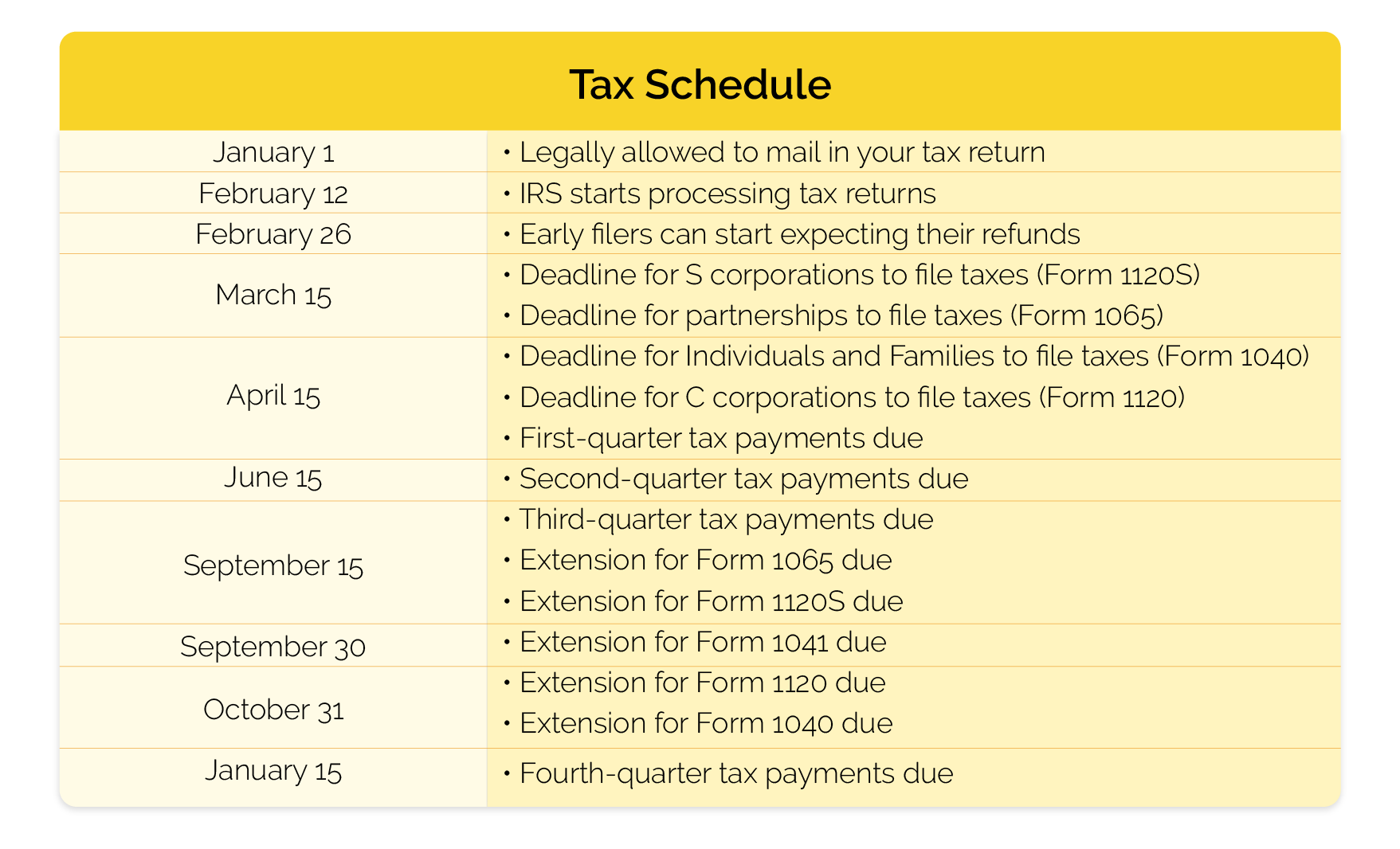

Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. Due date for 2025 tax payment.

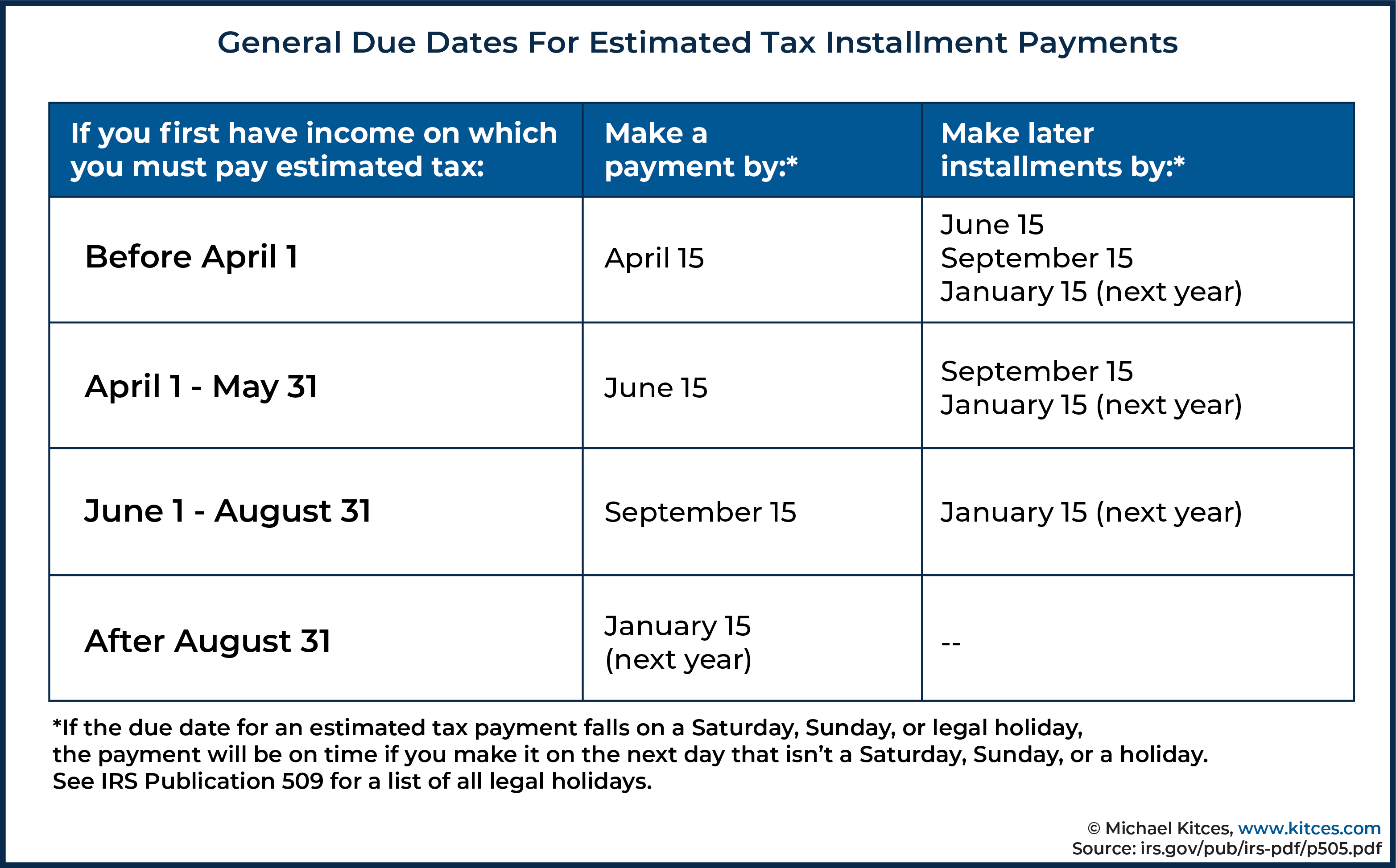

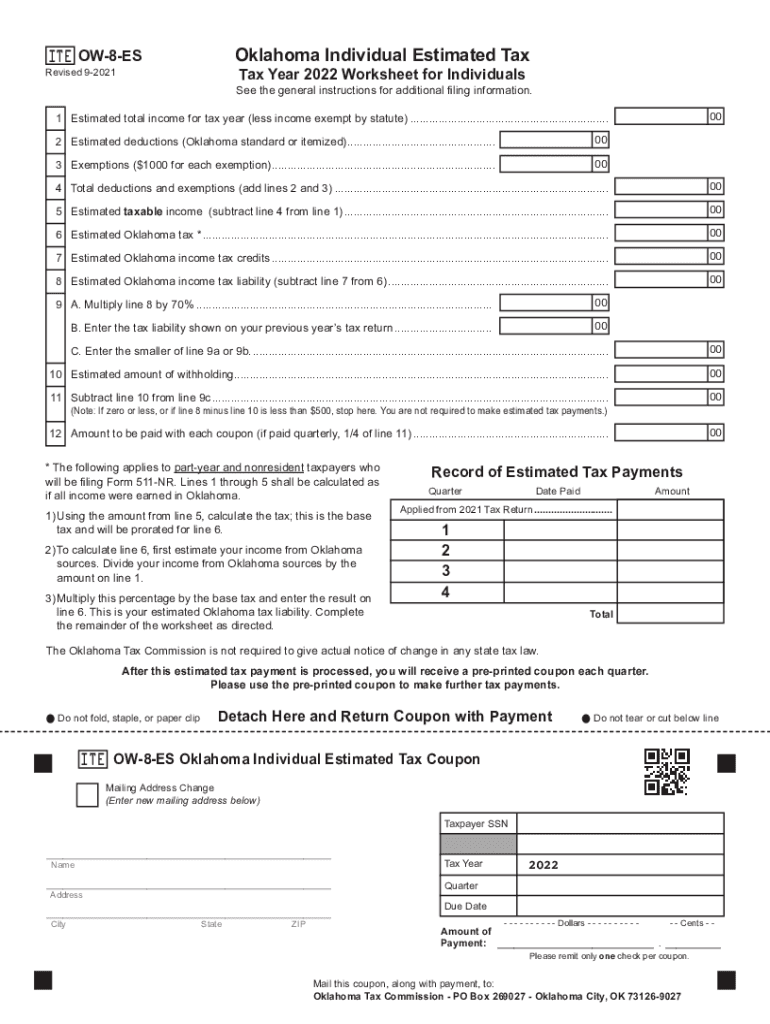

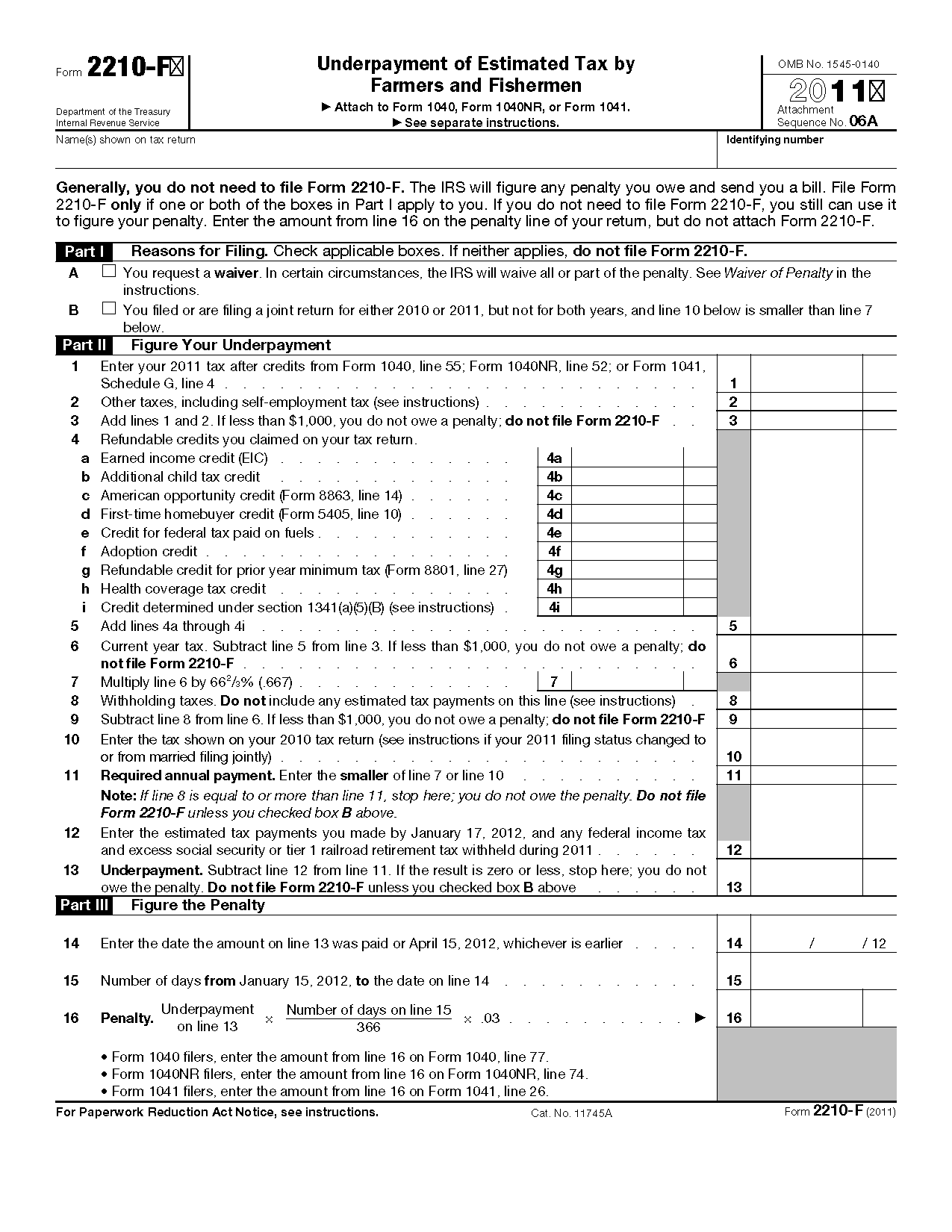

Final estimated tax payment for 2025 due. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

2025 Irs Quarterly Payments Elana Harmony, Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. Irs begins processing 2025 tax returns.

Irs Tax Payment Schedule 2025 Elie Nicola, Making estimated tax payments means that you need to estimate how much income you’re likely to make for. For the 2025 tax year, the estimated tax payment deadlines are as follows:

Irs Estimated Tax Payments 2025 Due Dates Fionna Beitris, Irs begins processing 2025 tax returns. The table below shows the payment deadlines for 2025.

Irs Form For Quarterly Taxes 2025 Neala Viviene, Payment is due by april 15,. Early bird registration rate expires june 17.

How Do I Calculate My Estimated Taxes For 2025 Hanny Kirstin, Due date for 2025 tax payment. Making estimated tax payments means that you need to estimate how much income you’re likely to make for.

Irs Tax Return 2025 Status Beret Ceciley, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year.

Estimated Tax Due Dates 2025 Form 2024Es 2025 Angele Valene, For income earned from january 1 to march 31, 2025: Filing deadline for 2025 taxes.

2025 Estimated Tax Due Dates Alice Brandice, Here are the key tax dates for the latter half of 2025: How to make estimated tax payments and due dates in 2025.

Federal Irs Estimated Taxes 2025 Gussi Tomasina, The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year. First estimated tax payment due;

Irs Estimated Tax Payment Deadlines 2025 Drucy Giralda, How to read the irs refund processing. Here are the key tax dates for the latter half of 2025:

The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year.